GST Collection of India in FY 2023-24

Goods and Services Tax (GST) is an indirect tax levied on the supply of goods and services in India. It is one of the major reforms in the country’s tax structure, aimed at simplifying the tax system and promoting ease of doing business. The GST collection plays a crucial role in the government’s revenue generation and fiscal planning. In this article, we will take a look at the quarterly GST collection of India for the fiscal year 2023-24.

Disclaimer: This blog is solely for educational purposes.

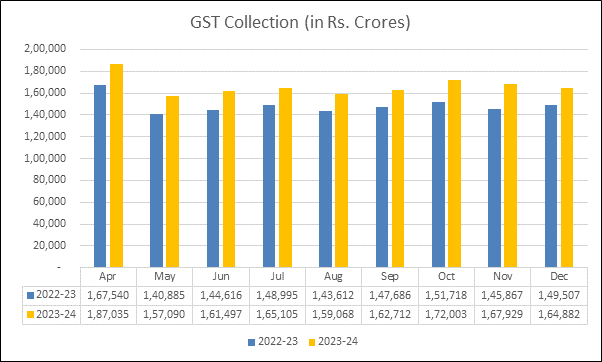

GST collection for December 2023 is Rs.1,64,882 crore, dropping from Rs.1,67,929 crore in November 2023.

Goods and Service Tax (GST) was implemented in India on 1st July 2017 by the then Finance Minister Arun Jaitely. Goods and Service Tax(GST). Ever since the introduction of the GST, there has been discussion on whether it will be successful. We did not get very satisfactory results for the first 3 years. Today India is collecting an average of Rs 1.66 lakh crore every month. This is very good growth.

Break up of GST Collections for December 2023

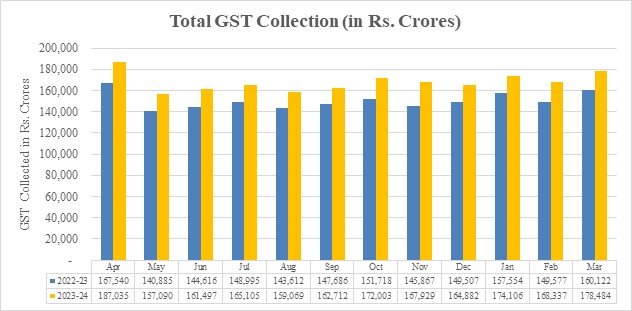

Posting a growth rate of 12% Y-o-Y, ₹14.97 lakh crore gross GST collection during April-December 2023 period

Gross GST collection averages ₹1.66 lakh crore in first 9 months of FY24. During the April-December 2023 period, gross GST collection witnessed a robust 12% y-o-y growth, reaching ₹14.97 lakh crore, as against ₹13.40 lakh crore collected in the same period of the previous year (April-December 2022).

The average monthly gross GST collection of ₹1.66 lakh crore in the first 9-month period this year represents a 12% increase compared to the ₹1.49 lakh crore average recorded in the corresponding period of FY23.

For read more about December GST collection: https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1992123

GST revenue collection for October 2023 is second highest ever, next only to April 2023, at ₹1.72 lakh crore; records increase of 13% Y-o-Y

The gross GST revenue collected in the month of October, 2023 is ₹ 1,72,003 crore out of which ₹ 30,062 crore is CGST, ₹ 38,171 crore is SGST, ₹ 91,315 crore (including ₹ 42,127 crore collected on import of goods) is IGST and ₹ 12,456 crore (including ₹ 1,294 crore collected on import of goods) is cess.

The government has settled ₹ 42,873 crore to CGST and ₹ 36,614 crore to SGST from IGST. The total revenue of Centre and the States in the month of October, 2023 after regular settlement is ₹72,934 crore for CGST and ₹ 74,785 crore for SGST.

The gross GST revenue for the month of October, 2023 is 13% higher than that in the same month last year. During the month, revenue from domestic transactions (including import of services) is also 13% higher than the revenues from these sources during the same month last year. The average gross monthly GST collection in the FY 2023-24 now stands at Rs. 1.66 lakh crore and is 11% per cent more than that in the same period in the previous financial year.

Reference: https://pib.gov.in/PressReleasePage.aspx?PRID=1973731

Role of GIG Economy

Gig economy is playing a very good role. This is the emerging sector of India. Gig economy will help the government in providing employment to people along with a means to earn good income and in building and strengthening India’s GDP.

For read more: https://atulgyan.com/the-scope-of-the-gig-economy-in-india-challenges-and-conclusion/

Conclusion

The quarterly GST collection of India for the fiscal year 2023-24 is expected to reflect the country’s economic recovery and the government’s efforts to revive key sectors. While the exact figures for each quarter are yet to be released, it is anticipated that the GST collection will show a positive trend as the economy gradually recovers from the impact of the COVID-19 pandemic. The government’s focus on vaccination, economic revival measures, and infrastructure development is likely to contribute to the overall GST collection. It is important to monitor the quarterly GST collection figures to assess the country’s economic progress and the effectiveness of the government’s policies.

Disclaimer: This blog is solely for educational purposes.